Accounting Accruals

In the intricate world of finance and accounting, the concept of accruals plays a pivotal role, influencing how businesses manage their financial statements and assess their performance. This method of accounting, which records expenses and revenues as they occur rather than when payments are made or received, is a cornerstone of modern financial practices. It provides a more accurate reflection of a company's financial position and performance, offering stakeholders a clearer view of its economic reality. Accrual accounting is a fundamental practice in modern business, and understanding its intricacies is essential for anyone involved in financial management or analysis.

Understanding the Basics of Accounting Accruals

Accounting accruals, a fundamental concept in accrual accounting, represent the recognition of expenses and revenues before the actual exchange of cash. This practice is based on the matching principle, aligning revenue recognition with the period in which it is earned and expense recognition with the period in which it is incurred. This method ensures a more accurate representation of a company’s financial performance and position, especially for long-term financial planning and strategy.

Consider a company that provides a service to a client. The service is rendered in December, but the client pays for it in January of the following year. Under the accrual accounting method, the company would recognize the revenue in December, the period in which the service was provided, rather than in January when the payment is received. This approach ensures that the company's financial statements reflect the actual business activity during a given period, providing a more realistic view of its financial health.

Types of Accruals

Accruals can be categorized into two main types: revenue accruals and expense accruals. Revenue accruals recognize revenue before it is received, while expense accruals recognize expenses before they are paid. Both types are essential for a comprehensive understanding of a company’s financial status and for making informed business decisions.

| Type of Accrual | Description |

|---|---|

| Revenue Accrual | Records revenue when it is earned, even if payment is not yet received. This is particularly useful for service-based businesses where services are rendered before payment. |

| Expense Accrual | Records expenses when they are incurred, regardless of when they are paid. This method ensures that expenses are matched to the period in which they contribute to revenue generation. |

For instance, a company might incur an expense in December for advertising services to be run in January. Under the accrual method, the expense would be recorded in December, the period in which it was incurred, to match it with the revenue it is expected to generate in January.

The Impact of Accruals on Financial Statements

Accruals have a significant influence on a company’s financial statements, particularly on the income statement and balance sheet. By recognizing revenue and expenses when they are earned or incurred, accrual accounting provides a more accurate picture of a company’s financial performance and health.

Income Statement

The income statement, also known as the profit and loss statement, is a financial statement that summarizes a company’s revenues, expenses, and profits over a specific period. Accrual accounting ensures that this statement accurately reflects the company’s financial performance during that period, regardless of when payments were made or received.

For example, if a company provides a service in December but doesn't receive payment until January, the revenue would be recorded in December under the accrual method, resulting in a higher reported revenue for that month. This approach provides a more realistic view of the company's financial performance, as it reflects the actual work done during the period.

Balance Sheet

The balance sheet is a snapshot of a company’s financial position at a specific point in time. It lists the company’s assets, liabilities, and equity. Accrual accounting ensures that the balance sheet accurately reflects the company’s financial obligations and rights, even if the related cash transactions have not yet occurred.

Consider an expense that a company incurs but doesn't pay for until the following month. Under the accrual method, this expense would be recorded as a liability on the balance sheet in the current month, reflecting the company's obligation to pay it in the future. This provides a more accurate representation of the company's financial commitments.

| Financial Statement | Impact of Accruals |

|---|---|

| Income Statement | Accruals ensure that revenues and expenses are recorded in the period they are earned or incurred, providing a more accurate representation of financial performance. |

| Balance Sheet | Accruals recognize expenses and revenues as assets or liabilities, reflecting the company's financial obligations and rights, even if cash transactions haven't occurred. |

Advantages of Accrual Accounting

The use of accrual accounting offers several benefits to businesses and stakeholders. By providing a more accurate and comprehensive view of a company’s financial health and performance, accrual accounting facilitates better decision-making and long-term planning.

Improved Financial Reporting

Accrual accounting enhances the accuracy and reliability of financial statements. By matching revenues and expenses to the periods in which they are earned or incurred, this method provides a more realistic representation of a company’s financial performance. This improved reporting helps stakeholders, such as investors and creditors, to better assess the company’s financial health and make informed decisions.

Enhanced Decision-Making

Accrual accounting provides a more comprehensive view of a company’s financial position, allowing for more informed decision-making. It helps business leaders to identify trends, evaluate the success of different strategies, and make projections for future performance. This data-driven approach to decision-making can lead to more effective business strategies and improved financial outcomes.

Facilitation of Long-Term Planning

Accrual accounting supports long-term financial planning by providing a clear view of a company’s financial performance over time. It allows businesses to analyze their financial data over multiple periods, identify areas for improvement, and set realistic financial goals. This long-term perspective is essential for strategic planning and ensuring the sustainability of the business.

| Advantage | Description |

|---|---|

| Improved Financial Reporting | Accrual accounting provides a more accurate and reliable representation of a company's financial health, enhancing the transparency and trustworthiness of financial statements. |

| Enhanced Decision-Making | By offering a comprehensive view of financial performance, accrual accounting enables data-driven decision-making, leading to more effective business strategies and outcomes. |

| Facilitation of Long-Term Planning | This method supports long-term financial planning by providing a clear, consistent view of financial performance over time, enabling businesses to set realistic goals and make sustainable financial decisions. |

Challenges and Considerations

While accrual accounting offers significant advantages, it also presents certain challenges and considerations that businesses and accountants must navigate. Understanding these aspects is crucial for effective financial management and reporting.

Estimation and Subjectivity

Accrual accounting often involves estimations and subjective judgments, particularly when dealing with expenses that are incurred but not yet paid. For instance, determining the amount of bad debt expense or the value of inventory that may become obsolete requires estimates and professional judgment. While these estimates are based on historical data and industry standards, they can introduce a degree of subjectivity into financial reporting.

Complexity and Compliance

Accrual accounting can be more complex than other methods, such as cash accounting. It requires a deeper understanding of accounting principles and practices, and it can be more time-consuming to implement. Additionally, businesses must comply with relevant accounting standards and regulations, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), which can add to the complexity.

Potential for Manipulation

The subjective nature of certain accruals can create opportunities for manipulation or fraud. For example, companies might understate expenses or overstate revenues to present a more favorable financial picture. While good internal controls and auditing practices can mitigate these risks, they are important considerations when adopting accrual accounting.

| Challenge | Description |

|---|---|

| Estimation and Subjectivity | Accrual accounting often involves estimations and subjective judgments, particularly for expenses that are incurred but not yet paid. This can introduce a degree of uncertainty into financial reporting. |

| Complexity and Compliance | Accrual accounting can be more complex and time-consuming than other methods. It also requires compliance with relevant accounting standards and regulations, adding to the overall complexity. |

| Potential for Manipulation | The subjective nature of certain accruals can create opportunities for manipulation or fraud. Companies might understate expenses or overstate revenues to present a more favorable financial picture. |

Future Implications and Innovations

As businesses and the accounting profession continue to evolve, the future of accrual accounting is poised for exciting developments and innovations. These advancements will likely shape how financial transactions are recorded and reported, enhancing the accuracy and efficiency of financial reporting.

Technological Advancements

The integration of technology in accounting practices, such as the use of accounting software and cloud-based systems, has already revolutionized the way financial transactions are recorded and reported. These tools streamline data collection and analysis, reducing the time and effort required for financial reporting. As technology continues to advance, we can expect even more efficient and accurate financial systems.

Enhanced Data Analysis

The field of data analytics is rapidly advancing, offering new opportunities for accountants and financial professionals to gain deeper insights from financial data. With advanced data analysis techniques, businesses can identify patterns, trends, and anomalies in their financial data, leading to more informed decision-making and improved financial strategies.

Standardization and Global Harmonization

Efforts towards global harmonization of accounting standards, such as the convergence of GAAP and IFRS, aim to create a unified set of accounting principles. This would simplify financial reporting for multinational companies and improve comparability of financial statements across borders. While these efforts are complex and ongoing, they hold the promise of a more standardized and efficient global financial reporting system.

| Future Development | Description |

|---|---|

| Technological Advancements | The continued integration of technology in accounting practices will lead to more efficient and accurate financial systems, streamlining data collection and analysis. |

| Enhanced Data Analysis | Advanced data analytics techniques will provide deeper insights from financial data, leading to more informed decision-making and improved financial strategies. |

| Standardization and Global Harmonization | Efforts towards global harmonization of accounting standards will simplify financial reporting for multinational companies and improve comparability of financial statements. |

Conclusion

In conclusion, accrual accounting is a critical concept in modern financial practices, offering a more accurate and comprehensive view of a company’s financial health and performance. By recognizing revenue and expenses when they are earned or incurred, accrual accounting provides valuable insights for decision-making, strategic planning, and long-term sustainability.

While accrual accounting presents certain challenges and considerations, these can be effectively managed through a combination of professional expertise, robust internal controls, and adherence to accounting standards and regulations. As we look to the future, technological advancements, enhanced data analysis, and standardization efforts promise to further enhance the practice of accrual accounting, leading to more efficient, accurate, and standardized financial reporting.

As businesses continue to evolve and adapt to changing market conditions, the role of accrual accounting will remain vital, providing a solid foundation for financial management and reporting. By understanding and effectively utilizing accrual accounting, businesses can make more informed decisions, improve their financial performance, and enhance their overall financial health.

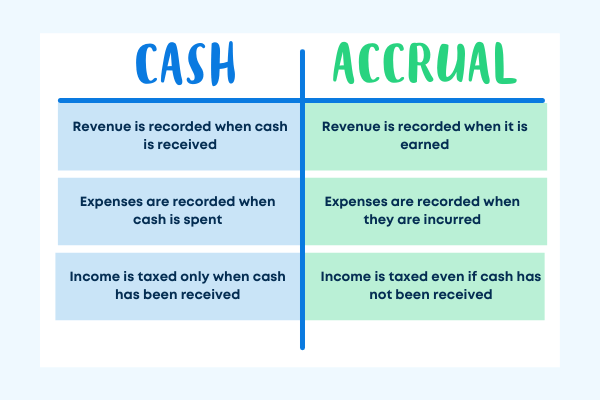

What are the key differences between accrual accounting and cash accounting?

+Accrual accounting recognizes revenue and expenses when they are earned or incurred, regardless of when payment is received or made. In contrast, cash accounting recognizes revenue when payment is received and expenses when payment is made. Accrual accounting provides a more accurate view of a company’s financial performance over time, while cash accounting is simpler and more immediate.

How do accruals impact a company’s financial ratios and metrics?

+Accruals can significantly influence a company’s financial ratios and metrics. For instance, they can impact profitability ratios by ensuring that expenses are matched to the period in which they contribute to revenue generation. Similarly, accruals can affect liquidity ratios by reflecting the company’s financial obligations and rights, even if cash transactions haven’t occurred.

What are some common challenges or pitfalls to avoid when using accrual accounting?

+One common challenge is ensuring that accruals are estimated accurately and reasonably. Overestimating or underestimating accruals can lead to inaccurate financial reporting. Additionally, businesses should maintain robust internal controls to prevent potential manipulation or fraud. Regular reviews and audits can help ensure the integrity of financial statements.