Download 1099 Misc

The 1099-MISC form is a crucial document in the United States tax system, particularly for independent contractors, freelancers, and businesses. It is used to report various types of income and payments made to individuals or entities, ensuring compliance with tax regulations. This article aims to provide an in-depth guide to downloading and understanding the 1099-MISC form, covering its purpose, relevance, and practical implications.

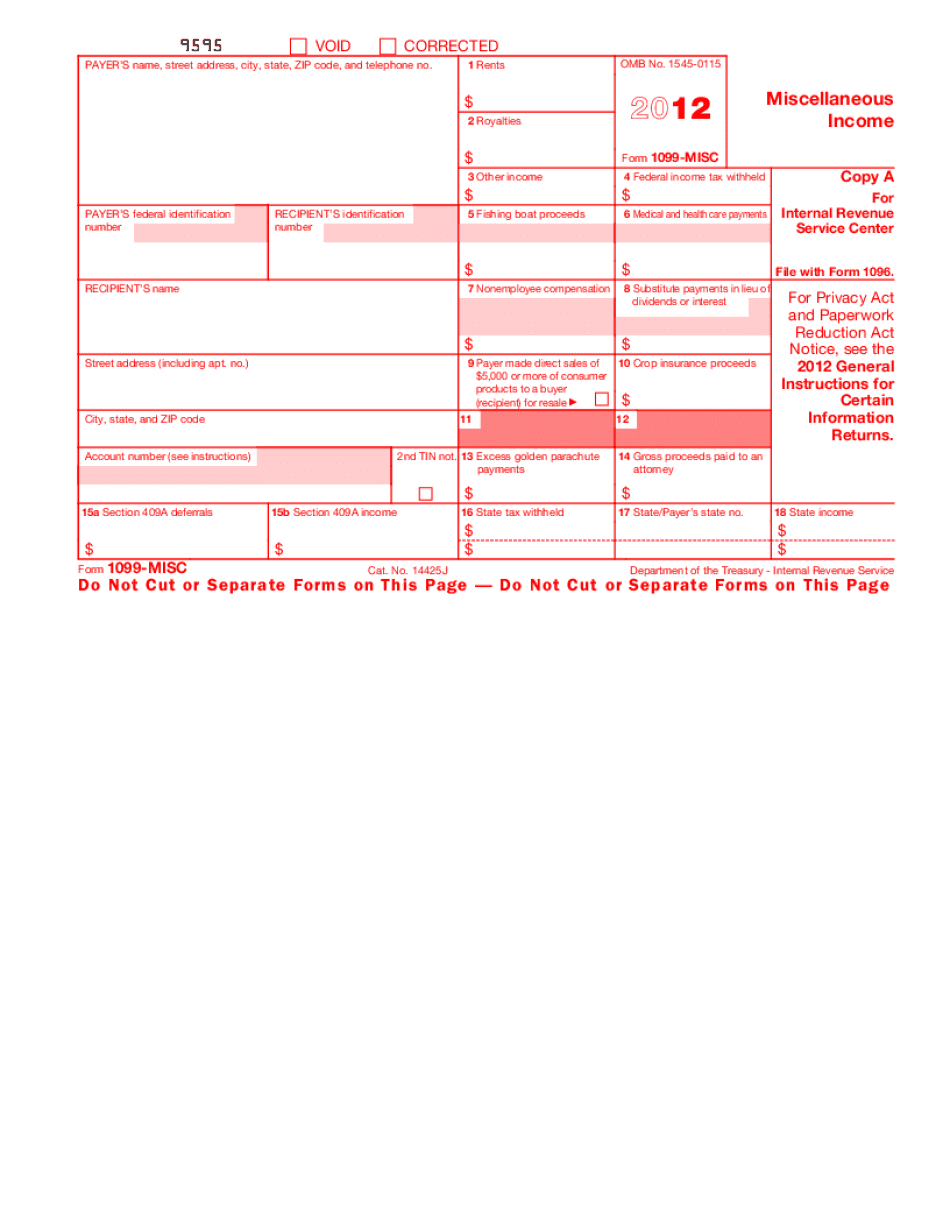

Understanding the 1099-MISC Form

The 1099-MISC, or the Miscellaneous Income form, is a tax document issued by businesses, payers, or organizations to report certain types of payments made to non-employee workers or other entities. It plays a vital role in the tax reporting process, helping the Internal Revenue Service (IRS) track income and ensure proper tax obligations are met.

Key Features and Uses of the 1099-MISC

This form is versatile and captures a wide range of income types, including:

- Non-employee compensation: Payments made to independent contractors, freelancers, or self-employed individuals for services rendered.

- Rents: Income received from renting property, equipment, or other assets.

- Awards and prizes: Monetary awards or prizes exceeding certain thresholds, often related to contests, competitions, or giveaways.

- Fisheries: Income derived from commercial fishing activities.

- Medical and health care payments: Reimbursements or payments made to patients or healthcare providers for medical services.

- Crop insurance proceeds: Payments received from crop insurance policies due to losses or damages.

Who Needs to File a 1099-MISC

The 1099-MISC is typically required for payments exceeding specific thresholds, which vary based on the type of income. For instance, non-employee compensation payments must be reported if they exceed 600 in a calendar year. Similarly, rent payments above 600, awards and prizes above 600, and fisheries income over 600 also trigger the need for a 1099-MISC.

It's important to note that businesses and organizations are responsible for issuing 1099-MISC forms to the recipients of these payments. This ensures that the recipients have a record of their income and can accurately report it on their tax returns.

Downloading the 1099-MISC Form

Obtaining the 1099-MISC form is straightforward, as it is available directly from the IRS website. The process is designed to be user-friendly and accessible to both businesses and individuals.

Step-by-Step Guide to Downloading

- Visit the Internal Revenue Service (IRS) website. This is the official source for all tax-related forms and publications.

- Navigate to the “Forms and Publications” section. This section provides a comprehensive list of all IRS forms, including the 1099-MISC.

- Search for “1099-MISC” using the search bar or browse through the list of forms. The IRS website offers a user-friendly interface for easy form identification.

- Once you locate the 1099-MISC form, click on it to access its dedicated page. Here, you will find detailed information about the form, including instructions, recent updates, and relevant publications.

- On the form’s page, look for the “Download” or “Print” option. This will provide you with the ability to save the form as a PDF file or print it directly from your browser.

- Choose the appropriate option based on your needs. If you prefer a digital copy, download the PDF. If you require a physical copy, print the form using your printer.

- Ensure you have the latest version of the form. The IRS regularly updates its forms, so it’s essential to download the most recent version to avoid any discrepancies or penalties.

By following these simple steps, you can easily obtain the 1099-MISC form and begin the process of accurately reporting income and payments. Remember, timely and accurate reporting is crucial to avoid any issues with the IRS.

Completing and Filing the 1099-MISC Form

Completing the 1099-MISC form requires attention to detail and accurate information. It is essential to understand the different sections of the form and what information is required in each.

Step-by-Step Guide to Completing

- Identify the correct box(es) for the type of income being reported. As mentioned earlier, the 1099-MISC covers various income types, and each has a designated box on the form.

- Enter the payer’s information in the designated sections. This includes the payer’s name, address, and taxpayer identification number (TIN) or Employer Identification Number (EIN). Ensure the information is accurate and up-to-date.

- Provide the recipient’s details. This includes the recipient’s name, address, and TIN or Social Security Number (SSN). It is crucial to obtain this information accurately, as any errors can lead to delays or penalties.

- Report the income amount. Enter the total income amount for the specific type of payment in the appropriate box. Ensure you are reporting the correct amount and that it aligns with your records.

- Sign and date the form. The payer must sign and date the form to verify its accuracy and authenticity. This is a critical step to ensure compliance with tax regulations.

Once the form is completed, it must be filed with the IRS and provided to the recipient. The filing deadline for the 1099-MISC form is typically January 31st of the year following the tax year in question. It is essential to meet this deadline to avoid penalties.

Filing Options

The IRS offers several filing options for the 1099-MISC form, depending on the number of forms being filed and the payer’s preferences.

- Paper filing: Payer can print the completed forms and mail them to the IRS. This option is suitable for a small number of forms and those who prefer a more traditional approach.

- Electronic filing: For larger volumes of forms, the IRS provides an electronic filing option. This can be done through approved software or online filing systems, making the process more efficient and reducing the risk of errors.

- Third-party filing: Some payers may choose to engage a third-party filing service to handle the filing process on their behalf. This option can be beneficial for businesses with complex filing requirements or those who prefer outsourcing this task.

Regardless of the filing option chosen, it is crucial to ensure timely filing and maintain accurate records. The IRS has stringent guidelines and penalties for late or inaccurate filings, so payers must stay informed and compliant.

Common Misconceptions and FAQs

The 1099-MISC form, while straightforward, can sometimes be misunderstood or lead to confusion. Here are some common misconceptions and frequently asked questions to provide further clarity:

Do I need to file a 1099-MISC for every payment I make?

+No, the requirement to file a 1099-MISC is based on the type and amount of payment. Only certain types of payments, such as non-employee compensation, rents, and awards, need to be reported if they exceed the specified thresholds. It's essential to understand the specific rules for each income type.

<div class="faq-item">

<div class="faq-question">

<h3>Can I use the 1099-MISC form for employee payments?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>No, the 1099-MISC form is specifically designed for non-employee payments. For employee payments, such as wages or salaries, you would use Form W-2. It's crucial to use the correct form to avoid confusion and ensure compliance with tax regulations.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any penalties for not filing a 1099-MISC when required?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, the IRS imposes penalties for failure to file or for filing inaccurate 1099-MISC forms. The penalties can range from $50 to $270 per form, depending on the timing and nature of the error. It's important to understand the potential consequences and stay compliant to avoid these penalties.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I correct an error on a previously filed 1099-MISC form?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you discover an error on a previously filed 1099-MISC form, you must file a corrected form. This involves completing a new 1099-MISC form with the correct information and indicating that it is a correction. You should also notify the recipient of the change. It's essential to handle corrections promptly to minimize any potential issues.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any alternatives to the 1099-MISC form for reporting income?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, depending on the type of income, there may be alternative forms or reporting methods. For instance, certain types of income, such as interest or dividends, are reported using Form 1099-INT or Form 1099-DIV, respectively. It's crucial to understand the specific requirements for each type of income and use the appropriate form.</p>

</div>

</div>

Understanding the 1099-MISC form and its proper use is essential for businesses, payers, and recipients alike. By following the guidelines and staying informed, individuals and entities can ensure accurate reporting and maintain compliance with tax regulations.