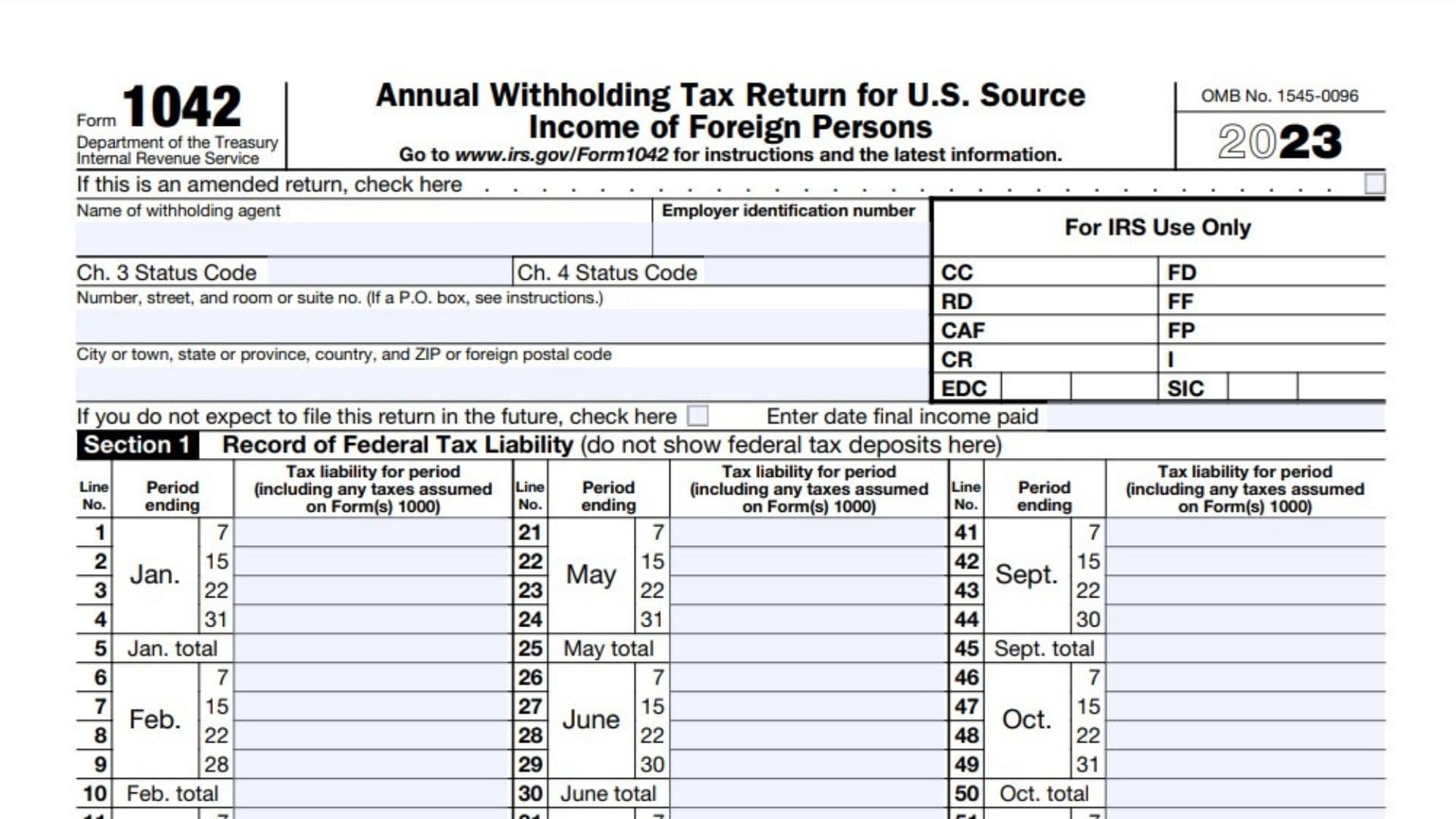

Form 1042 S Tax Return

In the complex world of international tax compliance, the Form 1042-S holds significant importance for both foreign individuals and US-based organizations. This form, often referred to as the "US Withholding Tax Return for Foreign Persons," is a critical tool for reporting certain payments made to non-resident aliens and foreign entities. It plays a pivotal role in ensuring tax obligations are met and facilitating smooth international financial transactions.

Understanding the Form 1042-S: A Comprehensive Guide

The Form 1042-S is a detailed document that requires careful completion and submission to the Internal Revenue Service (IRS). It is designed to report various types of income, including:

- Dividends and interest paid to foreign investors.

- Rents and royalties received by foreign entities.

- Withholdings from foreign individuals' US-sourced income.

- Proceeds from the sale of US property by foreign persons.

The complexity of this form lies in its comprehensive nature, requiring precise information on each payment made to a foreign person or entity. This includes their tax identification number, country of residence, and the specific type and amount of income earned.

Key Considerations for Filing

When preparing a Form 1042-S, several critical factors must be taken into account. Firstly, the filer must determine the tax status of the foreign recipient. This involves understanding whether they are a resident alien, non-resident alien, or a foreign entity. The tax implications and reporting requirements vary significantly based on this status.

Secondly, the source of income is a crucial determinant. Income sourced within the US, such as rent from a US property or dividends from a US corporation, often requires different reporting and withholding tax treatments compared to income sourced abroad.

Lastly, the type of payment is essential. Different types of income have unique reporting requirements and tax rates. For instance, dividends and interest may be subject to different withholding tax rates than royalties or rents.

| Payment Type | Reporting Frequency |

|---|---|

| Dividends | Annually |

| Interest | Annually |

| Rents | Annually |

| Royalties | Annually |

The Filing Process: A Step-by-Step Guide

Completing and filing the Form 1042-S is a multi-step process that requires attention to detail. Here’s a comprehensive guide to ensure a smooth filing experience:

Step 1: Gather Relevant Information

Before beginning the filing process, it’s crucial to collect all necessary information. This includes the recipient’s:

- Full name and address (both foreign and US, if applicable)

- Taxpayer Identification Number (TIN) or Individual Taxpayer Identification Number (ITIN)

- Country of residence and tax status

- Details of the income earned, including the type, amount, and date of payment

Step 2: Determine Withholding Tax Rates

The next step is to calculate the appropriate withholding tax rate for each payment. This rate depends on the type of income, the recipient’s tax status, and the applicable tax treaty (if any). The IRS provides Publication 515, which offers comprehensive guidance on determining withholding tax rates.

Step 3: Complete the Form

With the necessary information and withholding tax rates determined, it’s time to fill out the Form 1042-S. This form consists of multiple sections, each requiring specific details:

- Recipient Information: This includes the recipient's name, address, and tax identification number.

- Payer Information: Here, the filer provides their own details, such as name, address, and EIN (Employer Identification Number) or SSN (Social Security Number).

- Income Details: Each payment made to the recipient is listed, including the type of income, date, and amount. The withholding tax amount is also recorded.

- Foreign Status Information: This section captures the recipient's tax status, country of residence, and any applicable tax treaty benefits.

Step 4: Attach Schedules and Supporting Documents

In many cases, additional schedules and supporting documents are required to be attached to the Form 1042-S. These can include:

- Schedule A: Used to report payments to multiple recipients or to correct errors on previously filed forms.

- W-8BEN (Certificate of Foreign Status): This form is provided by the foreign recipient to certify their tax status and claim any treaty benefits.

- W-9 (Request for Taxpayer Identification Number): If the recipient is a US person, this form is used to obtain their TIN.

Step 5: Submit the Form and Pay Withheld Taxes

Once the Form 1042-S is complete, it must be submitted to the IRS by the due date. This can be done electronically through the IRS’ FIRE system or by mailing the paper form to the appropriate IRS service center. Simultaneously, the withheld taxes must be remitted to the IRS.

Navigating Common Challenges and Best Practices

While the Form 1042-S is a crucial tool for international tax compliance, it can present certain challenges. Here are some common issues and best practices to mitigate them:

Issue 1: Incomplete or Incorrect Information

One of the most frequent challenges is obtaining accurate and complete information from foreign recipients. This can be mitigated by:

- Implementing robust data collection processes, including online forms or secure portals for recipients to provide their details.

- Conducting regular data validation checks to identify and rectify any inconsistencies or errors.

- Educating recipients about the importance of accurate information and the potential consequences of errors.

Issue 2: Determining Tax Status and Treaty Benefits

Determining the tax status of foreign recipients and applying the correct tax treaty benefits can be complex. To address this:

- Engage tax professionals or legal advisors with expertise in international tax matters.

- Utilize resources like the IRS Publication 515 and the IRS Treaty Articles for guidance.

- Stay updated with the latest tax treaty developments and changes in tax laws.

Issue 3: Timely Filing and Payment

Ensuring timely filing of the Form 1042-S and remitting withheld taxes can be a logistical challenge. Consider these best practices:

- Set up internal processes and reminders to ensure forms are completed and filed by the due date.

- Establish a secure payment system to remit withheld taxes promptly and accurately.

- Regularly review and update processes to accommodate changes in tax laws or filing requirements.

Future Implications and Industry Insights

As the global economy continues to evolve, the role of the Form 1042-S in international tax compliance is likely to become even more critical. Here are some key insights and future implications to consider:

Increased Focus on Digital Transformation

The tax industry is increasingly adopting digital technologies to streamline processes and enhance compliance. This trend is likely to continue, with more emphasis on:

- Online filing systems and portals to simplify the Form 1042-S submission process.

- Data analytics and AI to improve data accuracy and identify potential errors or fraud.

- Blockchain technology to enhance security and transparency in international transactions.

Evolving Tax Treaties and Regulations

Tax treaties and international tax regulations are subject to change, often to address new economic realities or combat tax evasion. Stay informed about:

- Updates to existing tax treaties and the potential impact on withholding tax rates and reporting requirements.

- New tax treaties being negotiated and their potential implications for international tax compliance.

- Changes in tax laws, such as the introduction of new reporting requirements or tax rates.

Enhanced Emphasis on Compliance

With the increasing complexity of international transactions and the heightened focus on tax evasion, compliance will become even more critical. Consider:

- Implementing robust internal controls and processes to ensure accurate reporting and timely filing.

- Investing in ongoing professional development for tax professionals to stay abreast of the latest compliance requirements.

- Collaborating with industry peers and tax authorities to share best practices and address common challenges.

Conclusion

The Form 1042-S is a critical tool for ensuring compliance in the complex world of international tax. By understanding its purpose, navigating the filing process, and staying informed about industry developments, individuals and organizations can effectively manage their international tax obligations. As the global economy continues to evolve, the role of this form in facilitating smooth international financial transactions will only grow in importance.

What is the due date for filing the Form 1042-S?

+The due date for filing the Form 1042-S is typically March 15th of the year following the calendar year in which the income was paid. However, if the due date falls on a Saturday, Sunday, or legal holiday, the due date is extended to the next business day.

Can the Form 1042-S be filed electronically?

+Yes, the Form 1042-S can be filed electronically through the IRS’ FIRE system. This system allows filers to submit the form and any required schedules or attachments securely and efficiently.

What are the penalties for non-compliance with Form 1042-S filing requirements?

+Non-compliance with Form 1042-S filing requirements can result in significant penalties. These may include failure-to-file penalties, failure-to-pay penalties, and interest on unpaid taxes. It’s crucial to ensure timely and accurate filing to avoid these penalties.