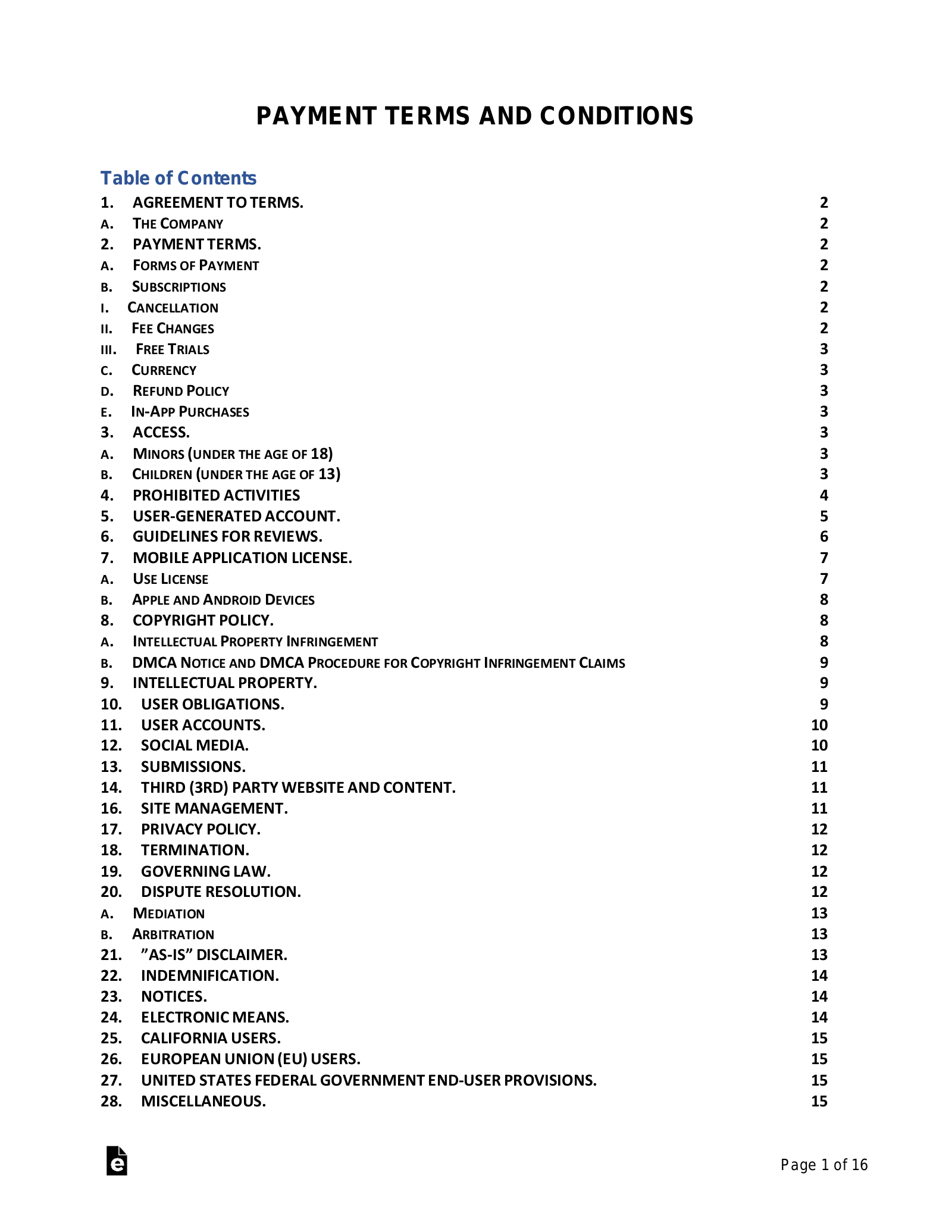

Payment Terms

In the world of business and finance, the concept of payment terms plays a crucial role in shaping the relationships between buyers and sellers. Payment terms refer to the agreed-upon conditions and timelines for settling financial transactions, ensuring a smooth flow of cash and maintaining strong business partnerships. These terms can vary significantly across industries, businesses, and even individual transactions, making it essential for both parties to understand and negotiate them effectively.

As an expert in the field, I aim to provide an in-depth analysis of payment terms, their significance, and the best practices for negotiating and managing them. By the end of this article, readers will have a comprehensive understanding of how payment terms impact their business operations and strategies, empowering them to make informed decisions and foster healthier financial relationships.

Understanding Payment Terms: A Comprehensive Overview

Payment terms, at their core, are the financial guidelines that govern the timing and conditions of payment in a business transaction. They define when, how, and under what circumstances the buyer is expected to remit payment to the seller. These terms can be as simple as a due date for payment or as complex as installment plans, milestone-based payments, or even performance-based payment structures.

The flexibility and customization of payment terms are key to their importance. Different industries, businesses, and projects have unique financial needs and constraints. For instance, a construction project might require staged payments as the work progresses, while a software development firm might prefer payment upon project completion and client approval. Understanding and accommodating these diverse needs is crucial for fostering mutually beneficial business relationships.

Common Types of Payment Terms

Payment terms can be broadly categorized into several common types, each with its own advantages and considerations. These include:

- Net Terms: Perhaps the most well-known, net terms refer to a specific number of days after an invoice date that payment is due. For instance, "Net 30" means payment is due 30 days after the invoice date. This is a common practice in many industries and provides a clear and straightforward payment timeline.

- Due on Receipt: In this scenario, payment is expected as soon as the invoice is received. This term is often used for small purchases or in situations where the seller needs immediate cash flow.

- Progress Payments: Commonly used in large projects or long-term contracts, progress payments are made in installments as the work progresses. These payments are often based on predefined milestones or completion percentages, ensuring the seller receives regular cash flow for their work.

- Retainage: Retainage involves withholding a certain percentage of each payment until the project or service is fully complete and approved. This provides an incentive for the seller to deliver high-quality work and ensures the buyer has some leverage if issues arise.

- Performance-Based Payments: In certain industries, payments are tied to specific performance metrics or deliverables. For example, in marketing, payments might be linked to the success of a campaign as measured by predefined KPIs. This term aligns the seller's incentives with the buyer's goals.

Each of these payment terms serves a unique purpose and is tailored to the specific needs of the business transaction. The ability to negotiate and agree on the right terms is a key aspect of successful business partnerships.

Negotiating Payment Terms: A Strategic Approach

Negotiating payment terms is an art that requires a deep understanding of both parties' needs and a strategic approach to finding a mutually beneficial solution. It involves balancing the need for healthy cash flow with the desire to maintain strong business relationships.

Key Considerations for Negotiation

- Industry Standards: Understanding the standard payment terms in your industry is crucial. This knowledge provides a foundation for negotiation and ensures that the terms are realistic and feasible for both parties.

- Cash Flow Needs: Assess your own business's cash flow requirements. Do you need immediate payments to cover expenses, or can you accommodate longer payment terms? Understanding your financial needs is vital for effective negotiation.

- Risk Assessment: Consider the risk involved in the transaction. Are there uncertainties or potential delays that could impact payment? If so, it might be wise to negotiate terms that provide some protection or flexibility.

- Relationship Building: Payment terms are not just about money; they are also about building trust and long-term partnerships. Being flexible and accommodating, within reason, can foster stronger business relationships and open doors to future opportunities.

- Alternative Payment Methods: Explore options beyond traditional payment terms. For instance, offering early payment discounts or accepting partial payments upfront can be attractive to buyers and provide a steady cash flow for your business.

Best Practices for Negotiating Payment Terms

- Start Early: Begin negotiating payment terms as early as possible in the transaction process. This allows for more flexibility and time to find a mutually agreeable solution.

- Be Prepared: Have a clear understanding of your business's financial needs and goals. Be ready to explain why certain payment terms are important to you and how they benefit the overall transaction.

- Stay Flexible: While it's important to have your preferred terms, be open to compromise. Negotiation is a two-way street, and finding a middle ground can lead to more successful outcomes.

- Use Data: Support your arguments with relevant data and industry benchmarks. This can help reinforce your position and demonstrate the fairness of your proposed terms.

- Consider the Long-Term: Think beyond the immediate transaction. Building a strong relationship and a history of successful transactions can lead to more favorable terms in the future.

By approaching payment term negotiations with a strategic mindset and a focus on mutual benefit, businesses can foster healthier financial relationships and ensure a steady cash flow to support their operations.

Managing Payment Terms: Strategies for Success

Once payment terms are agreed upon, effective management is crucial to ensure timely payments and maintain positive business relationships. Here are some strategies to manage payment terms successfully:

Clear Communication

Ensure that all payment terms are clearly communicated and documented. This includes the due dates, any penalties for late payments, and the preferred method of payment. Clear communication reduces misunderstandings and sets the right expectations.

Invoice Management

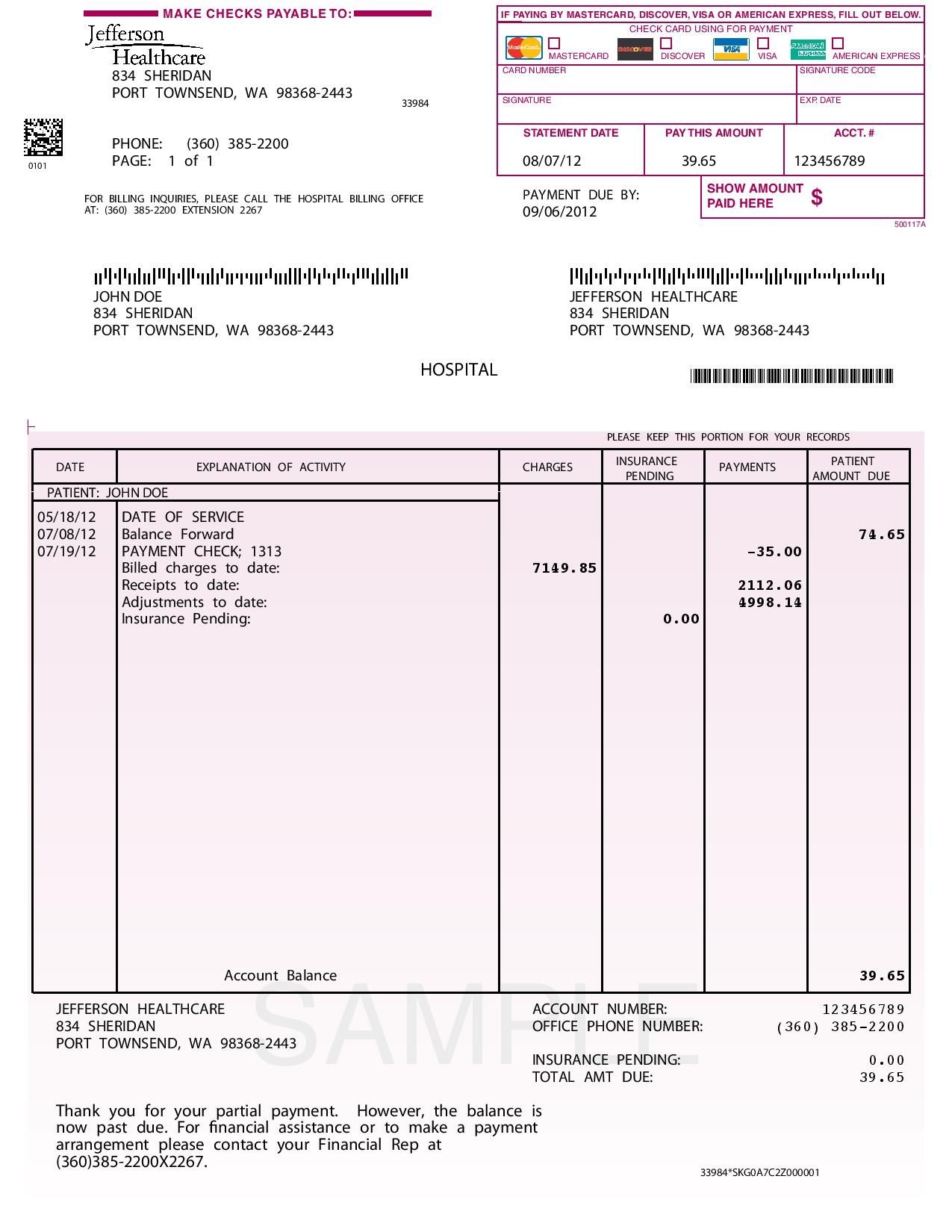

Implement robust invoice management practices. Send invoices promptly, ensure they are accurate and detailed, and consider using automated invoicing systems to streamline the process. Timely and accurate invoicing is key to prompt payment.

Early Payment Incentives

Offer incentives for early payments. This could be a simple discount or a loyalty program. Early payment incentives can improve cash flow and strengthen buyer-seller relationships.

Late Payment Penalties

Clearly outline the penalties for late payments in your payment terms. This can include late fees, interest charges, or even legal actions in severe cases. Late payment penalties serve as a deterrent and encourage timely payments.

Payment Reminders and Follow-Ups

Implement a systematic approach to payment reminders. Send polite but firm reminders at regular intervals before the due date. If payments are still overdue, follow up with a more assertive approach, highlighting the agreed-upon payment terms and any potential consequences.

Dispute Resolution

Establish a clear and fair dispute resolution process. This ensures that any issues or disagreements over payments can be resolved quickly and amicably, minimizing potential damage to the business relationship.

Stay Informed

Keep up with industry trends and best practices related to payment terms. Stay informed about changes in regulations, technological advancements, and evolving payment methods. Being proactive in adapting to these changes can give your business an edge.

Future Trends and Implications

The world of payment terms is evolving, driven by technological advancements and changing business dynamics. Here’s a glimpse into the future and its potential implications:

Digital Payments and Cryptocurrencies

The rise of digital payments and cryptocurrencies is transforming the way businesses transact. These methods offer faster, more secure, and often more cost-effective ways of transferring money. Embracing these technologies can improve cash flow and reduce administrative burdens associated with traditional payment methods.

Smart Contracts and Blockchain

Smart contracts, powered by blockchain technology, have the potential to revolutionize payment terms. These self-executing contracts can automate payments based on predefined conditions, reducing the need for manual intervention and minimizing the risk of errors or disputes.

Alternative Lending and Financing Options

The emergence of alternative lending platforms and financing options provides businesses with more flexibility in managing their cash flow. These options, such as invoice financing or supply chain financing, can help businesses navigate tight payment terms or cash flow challenges.

Sustainable and Ethical Payment Practices

There is a growing emphasis on sustainable and ethical business practices, including payment terms. Businesses are increasingly expected to adopt fair and transparent payment practices, particularly when dealing with small businesses or suppliers in developing countries. This trend promotes healthier business ecosystems and social responsibility.

Globalization and Cross-Border Transactions

With the increasing globalization of business, cross-border transactions are becoming more common. Managing payment terms in these scenarios can be complex due to varying cultural norms, legal frameworks, and currency fluctuations. Businesses need to adapt their payment strategies to navigate these challenges effectively.

AI and Data Analytics

Artificial Intelligence (AI) and data analytics are being leveraged to optimize payment terms and cash flow management. These technologies can analyze vast amounts of data to identify patterns, predict payment behaviors, and suggest optimal payment terms for different customers or transactions.

Conclusion: Navigating the Payment Terms Landscape

Payment terms are a critical aspect of any business transaction, shaping the financial dynamics and relationships between buyers and sellers. By understanding the diverse types of payment terms, adopting strategic negotiation approaches, and effectively managing these terms, businesses can ensure a healthy cash flow and foster stronger partnerships.

As the business landscape continues to evolve, staying informed about emerging trends and technologies is essential. Embracing these advancements can give businesses a competitive edge, improve cash flow management, and contribute to a more sustainable and ethical business environment.

In navigating the complex world of payment terms, businesses must strike a balance between protecting their financial interests and building long-lasting, mutually beneficial relationships. With a strategic mindset and a commitment to adaptability, businesses can thrive in an ever-changing financial landscape.

What are the key factors to consider when negotiating payment terms with a new client or supplier?

+When negotiating payment terms with a new client or supplier, it’s crucial to consider several factors. First, understand your own financial needs and cash flow requirements. Determine whether you need immediate payments or if you can accommodate longer payment terms. Additionally, assess the risk involved in the transaction and consider the potential impact of delays or non-payment. Lastly, remember that payment terms are not just about money; they also shape the relationship between the parties. Be open to compromise and find a balance that fosters a healthy, long-term partnership.

How can businesses encourage timely payments from their clients or customers?

+Encouraging timely payments involves a combination of clear communication, effective invoice management, and strategic incentives. First, ensure that payment terms are clearly communicated and documented, including due dates and any late payment penalties. Send invoices promptly and ensure they are accurate and detailed. Offer early payment incentives, such as discounts or loyalty programs, to motivate customers to pay early. Additionally, implement a systematic approach to payment reminders, starting with polite reminders before the due date and becoming more assertive if payments are overdue.

What are some common challenges businesses face when managing payment terms, and how can they be addressed?

+Businesses often face challenges such as late payments, payment disputes, and cash flow management issues when managing payment terms. To address these challenges, implement robust invoice management practices, including accurate and timely invoicing. Establish a clear and fair dispute resolution process to quickly resolve any payment disagreements. Additionally, consider offering early payment incentives and clearly communicating late payment penalties to encourage timely payments and deter late payments. Finally, stay informed about industry trends and technologies to adapt your payment strategies and stay ahead of potential challenges.